July 1, 2017 is the deadline for most entrepreneurs to switch from regular cash registers to cash registers that transmit information to the Federal Tax Service online. Since the beginning of February, tax inspectorates have stopped registering old-style cash registers, it is impossible (control tape).

In this regard, the issue of registering online cash registers is very relevant for entrepreneurs and heads of organizations. Let's look at how to go through this procedure step by step.

Advantages of early transition to online cash registers

Despite the fact that businessmen still have time during which they are allowed to use their usual cash registers, they will have to obey the Federal Law of July 3, 2016 No. 290-FZ, which introduced significant innovations to the Federal Law of May 22, 2003 No. 54-FZ Federal Law regulating the use of cash register equipment.

Why is it better to take care of this issue in advance? Entrepreneurs who decide to modernize cash accounting in advance receive the following advantages compared to their less efficient colleagues:

- the “voluntary” period of innovation allows you to get a temporary head start for the preparation, implementation and establishment of new systems and operations;

- there is still no rush to purchase the necessary models of devices;

- If the service life of the next EKLZ is coming to an end, there is no point in buying new tapes, because they will soon no longer be used.

Modify or replace cash registers

Before moving on to the general modernization of cash registers, an entrepreneur needs to decide whether to purchase new models of cash registers or invest in the modernization of existing ones.

To solve this problem, it is necessary to consider existing models for their possible modernization. To do this, you need to check whether these models are included in the register of equipment that can be upgraded, and also clarify until what year their use will be legal. Based on the data obtained, a decision can be made on the advisability of modernization.

What to look for when choosing a cash register model

If management decides to replace cash register equipment, then it is necessary to consciously select models that will be as convenient as possible and meet the requirements of a particular organization. Important factors that may influence your choice:

- "patency"- a parameter of the device, which is influenced by the number of operations performed (for example, a supermarket cash register requires high throughput, but for a company selling services, this parameter does not matter);

- maximum number of checks issued per day- each model has its own recommended norm, the factor is related to the characteristics of the organization’s activities;

- check printing speed- depends on the required pace of customer service;

- possibility of automatic check cutting- important for high throughput and print speed, practically unimportant for low machine load;

- cash register connection port- for some models, the port connector does not fit all computers; it is better to choose cash registers equipped with a USB port and cord;

- mobility or stationary- sometimes mobile models are very practical when you need, for example, to go to an important customer yourself to conclude a deal, while it is more convenient to have a stationary model in the office in case another client arrives;

- Availability of the model from the supplier- all other things being equal, it is better to choose a more affordable model, the delivery of which will not have to wait long.

How to register an online cash register correctly

The procedure for registering new-style cash register equipment is regulated in Article 4.2. the above-mentioned Federal Law. The procedure has been tested by the Federal Tax Service and fiscal data operators. The law allows you to choose one of the methods convenient for the entrepreneur for this.

- Fill out a paper application for registering a cash register, submit the document to any tax authority, and receive a registration card at the place of registration of the company (at “your” territorial tax office).

- Submit an application electronically through your personal account on the official website of the Federal Tax Service of the Russian Federation. To do this, entrepreneurs need an improved electronic signature - ESP, without which no electronic documents will be accepted for consideration. This CEP will need to be formalized one way or another.

Is it possible to use the usual registration rules?

The law allows the use of the previous procedure for registering cash registers, prescribed in the old version of Federal Law No. 290, until the end of 2017. However, this procedure will be valid with some serious reservations, which are not directly stated in the legislation, but tax authorities pay attention to them:

- Only outdated cash registers can be registered before the designated time; new models are not accepted for registration according to the old scheme;

- cash register models modernized for online operation, as well as new models, will have to be registered according to the updated regulations.

NOTE! From February 1, 2017, in accordance with paragraph 4 of Art. 7 Federal Law No. 290, in order to register a new cash register device for fiscal registration, it is necessary to conclude an agreement with a fiscal data operator (FDO), whose services will be paid. You can choose one of several providers of such services on the website of the Federal Tax Service of the Russian Federation.

Step-by-step instructions for registering an online cash register

What you need to start registering

Successful fiscalization of a new or modernized cash control apparatus in a tax authority requires the presence of three mandatory components:

- a cash register of the appropriate type with an active fiscal drive (you need to know their numbers);

- concluded agreement with the fiscal data operator;

- CEP (qualified electronic signature): UEP (enhanced electronic signature) - for individual entrepreneurs and KSKPEP (qualified electronic signature verification key certificate) for legal entities.

FOR YOUR INFORMATION! If you find it difficult to determine the numbers of a cash register and fiscal drive, this information is contained in the passports of these devices, and is also displayed on the diagnostic receipt stamped on the cash register.

Preliminary procedures before registering a cash register

- CEP. Checking the presence or issuing an electronic signature (ECS). A qualified electronic signature of the head of the organization is necessary to legalize a cash register, and not only. If you have already received it before, for example, with a 1C accounting license package, it will be quite suitable. If there is no signature, it must be completed.

- Conclusion of an agreement with the OFD. You need to select 1 company providing fiscal data operator services from 5 recommended ones, the list of which is contained on the Federal Tax Service website, and conclude an agreement on the provision of services.

IMPORTANT! It is convenient to interact with operators using the electronic service “1C-OFD”, which is included in the set of services of the official contract. Then the responsibility for connection will be shared by the Competence Centers, which are official partners of the 1C system.

Registration using a paper application

The complexity of this registration method is that the application form has not yet been approved by the Ministry of Finance, and therefore is mandatory for use. However, some tax authorities recommend using the form and procedure proposed in the form of a draft in the Ministry of Finance of the Russian Federation. If an entrepreneur decides to use this particular method, he will need to follow the following steps sequentially:

- Fill out the application form for registering the cash register in 2 copies. This is a rather complex process that involves correctly filling out data in several sections of the card. This needs to be done:

- handwritten with blue or black ink or printed on a printer;

- no gaps in any sections;

- without correction, corrections;

- on one side of a sheet of paper;

- separately for each CCP unit.

- The completed application is sent to the tax authority:

- personally by a representative of an organization or individual entrepreneur (have with you a document confirming such authority);

- by mail (with an inventory);

- The tax authority registers the received application, returning one copy with the appropriate marks to the submitter.

- Checking the data specified in the application by a tax specialist (if the information provided is unreliable, registration will be denied).

- The tax office will issue a registration number assigned to the cash register.

- The resulting digits of the number must be entered into the cash register in accordance with the manufacturer’s algorithm, after which the cash register will be able to print a registration report.

- After completing registration actions, you can ask the tax authority in writing to issue a registration card (it will be printed and given to the applicant with the note “Copy is correct”).

Registration of cash registers using your personal account online

For many users, registering a new type of cash register via the Internet turns out to be more convenient than through a personal visit. As mentioned above, for this you need to have an extended version of the ESP (electronic signature). Registering a cash register on the corresponding page of the Personal Account of the Federal Tax Service website is not very difficult. This can be done not by the manager himself, but by any person on his behalf, who will have all the relevant data to fill out the necessary fields.

- Authorization of the account user on the Federal Tax Service website. The first service of providing an electronic key is paid; it must be ordered at a special certification center. The electronic key will be valid for 1 year.

- First you need to go to the page where you can register. To do this, on the main page, select “Accounting for cash register equipment.”

- Click “Register a cash register”, and then select the item that allows for manual entry of the parameters of the registered cash register, namely:

- cash register installation address;

- the place where it will be installed (office, store, etc.);

- cash register model (must be selected from the list provided, serial number must be indicated);

- model of the fiscal drive and its number;

- purpose of cash registers (for offline mode, for mobile trading, strict reporting forms, payment for Internet services, etc.);

- Select from the list of fiscal data operators with whom the organization has an agreement.

- Check the entered information, sign electronically and submit the completed application.

- Click the link “Information about documents sent to the tax authority”, select the registration number of your application (RNM) and then the “Complete registration” button.

- Having received the registration number, you need to enter it into the cash register, as required by the manufacturer’s instructions, and print the “Registration Report”.

- Enter the data from the printed report no later than the next day after receiving the number in the appropriate fields:

- date and time of receipt of the fiscal sign (printed check report);

- number of the received document;

- fiscal sign (a unique registration number that will remain unchanged throughout the life of the cash register).

- The registration card can be printed by opening the “List of documents sent to the tax authority” tab.

IMPORTANT! If the entrepreneur was unable to complete the fiscalization on his own (print a check report), you need to contact the technical support of the cash register manufacturer.

Features of registration on the cash register itself

We are talking about point 7 - the generation of a “registration report”, the data from which must be entered into the registration field no later than 1 day after receiving the fiscal attribute - registration number. The procedure may vary slightly depending on the CCP model; in case of difficulties, it is better to consult the manufacturer and follow its instructions. The usual procedure for printing the registration report is as follows.

- On the cash register, select “Settings” from the menu.

- Follow the items “OFD”, and then “Registration”.

- In the “Registration” section, enter the following information:

- Full name of the individual entrepreneur or name of the organization (exactly matches the registration data at the tax office);

- place of settlement (address);

- TIN of the organization or individual entrepreneur;

- registration number of the cash register.

- Indicate the system by which the organization is taxed.

- Select from the proposed list the fiscal data operator with whom the agreement was concluded.

- Check that all fields are filled in and click the “Registration” button.

- The cash desk will print a check report, the data from which should complete the fiscalization of the cash register.

Registration of a modernized cash register machine

To register not a new, but a modernized cash register model, you need to follow any of the above schemes - “paper” or “electronic”. But before starting the procedure, one more preliminary step needs to be completed - to remove this device from the register on which it was previously registered (this must be done strictly before the end of 2017).

IMPORTANT INFORMATION! Presentation of the cash registers themselves during registration and/or deregistration is not required.

Registration of cash register in Moscow is mandatory for all organizations working with cash. If your organization accepted cash without punching a cash receipt, then the tax authorities may impose an administrative penalty on it in the form of a fine in the amount of 30 to 40 thousand rubles, and on officials - from 3 to 4 thousand rubles, in addition to the tax authorities can bring an organization to tax liability for “gross violation of income accounting rules,” which also entails a fine of 15 thousand rubles (the upper limit of the fine is not limited).

Registering cash register machines in Moscow

Registering a cash register machine with the tax authorities is a process that takes from 4 days to 2-3 weeks, depending on the queue of those wishing to register the cash register machine and deregister it. A list of documents that must be prepared to register a cash register with the tax office is added to the queues. Please note that below is a unified list of documents for registering cash register with the tax office. However, when filling out documents, you must be guided not only by the official explanations of the Federal Tax Service, but also by the wishes of the specific tax office.

List of documents for registering cash register machines

As of today, in 2013, to register and register the cash register with the tax authorities, you will need the following list of documents:

1. - 2 copies. in printed form;

2. - 1 copy. in printed form;

3. Technical passport (form) for the cash register with a completed commissioning certificate;

4. Agreement with the technical service center (original or notarized copy + regular copy certified by the organization’s seal);

5. A receipt with meter readings (if the machine was previously in operation);

6. The cashier-operator’s journal in completed form (form KM-4);

7. Logbook for calls to technical specialists (form KM-8);

8. (services) sold by the organization;

9. Power of attorney (if the documents are not submitted by the officials indicated in the application);

10. Certificate of state registration (original or notarized copy);

11. Certificate of registration with the tax office (original or notarized copy);

12. Passport of the reference version for the cash register, consisting of two sheets (original + double-sided photocopy with the organization’s seal);

13. Premises rental agreement (original or notarized copy);

Plus, some tax authorities may require

1. Lease agreement at the legal address (a copy certified by the organization’s seal);

2. Accounting and tax reporting for the last reporting period (photocopies with an inspector’s mark or, if the reporting was submitted by mail, the original signed by the manager and chief accountant + photocopy of the postal receipt).

List of documents for registration of a new EKLZ and replacement

1. Three acts of KM-2;

2. Certificate of technical conclusion;

3. Copies of Z-reports before and after replacement of ECLZ;

4. Brief report on the old ECLZ;

5. Activation of the new ECLZ;

6. Magazines KM-4, KM-8;

7. Cash register registration card;

8. CCP form;

9. Passport for a new EKLZ;

10. in 2 copies;

11. A double-sided copy of the additional page of the version passport, certified by the organization’s seal;

12. Power of attorney (except for the general director).

You can obtain more detailed information on registering cash registers from our specialists by calling: 500−84−55; (495) 644−33−17

We save your time and money!

Every enterprise that intends to carry out cash payments to customers must buy a cash register machine (CCM) and contact the Federal Tax Service to register it.

In order to do this as soon as possible, you need to familiarize yourself in advance with the sequence of actions that need to be performed for registration, collect all the necessary documents and take into account some important points that will facilitate the entire process.

Order

Before purchasing a cash register, you should make sure that this step is necessary: some types of activities can be carried out without using a cash register.

Cash registers should be purchased based on the functions required for a particular business: for example, the owner of a chain of grocery stores It’s better to buy a modern cash register with a screen, POS terminal and barcode reader.

An important point when choosing a device will be the presence of its name in the State Register and the presence of a secure control tape. You can buy a cash register at a service center, which can, for a fee, take care of the entire registration of the device. In the future, you will also need to contact the service center to service the cash register. Those who decide to act on their own should follow the steps required to register the device.

First you need to visit the tax office and find out important information about:

First you need to visit the tax office and find out important information about:

- the time of reception of the inspector who is responsible for registering the cash register;

- documents required for registration of cash register;

- registration procedure (is it possible to register in advance, or will you have to wait in line).

The application for registration of cash register must be marked with a seal, certifying that the enterprise has no debt to the state. The tax inspector sets the time when the cash register will be fiscalized.

The fourth stage is the fiscalization of cash register machines - the procedure takes place at the tax office, and a specialist from the service center where the device was purchased must be present.

The cash register must be supplied with all components and pre-filled with a receipt tape. If some parts of the cash register cannot be transported, the inspector sets a time at which he can arrive and carry out fiscalization.

Registration of the cash register machine with the tax office is completed after entering information about the device into the cash register register book. After this, the tax authority returns the original documents along with a card certifying the registration of the cash register.

List of documents

The following documents must be provided to register the cash register with the tax authorities:

The following documents must be provided to register the cash register with the tax authorities:

- application form for registration of cash register (the number of copies may vary depending on the Federal Tax Service);

- cash book(form KM 4), which must be filled out, numbered, laced, signed and sealed by the chief accountant (for individual entrepreneurs - manager). The inspector will put the date of fiscalization on it, certify it with a signature and stamp;

- log of calls to KKM repair specialists(form KM 8), which must be filled out, numbered, laced, signed and sealed;

- registration certificate KKM, which comes complete with a cash register;

- KKM version passport (original and copy);

- EKLZ passport;

- volumetric hologram“Service 20__”, with the specified year of placing the cash register for maintenance at the central service station;

- agreement with the central service center where cash register machines are serviced (original and copy);

- a lease agreement for the premises (or a certificate of ownership of the property) in which the cash register will be located (original and copy);

- power of attorney (needed if the documents are not submitted by the official whose name is indicated in the application); for individual entrepreneurs you need a power of attorney certified by a notary;

- self-adhesive stamps-seals installed by the CTO representative during registration;

- in some cases, you need to provide a receipt for the purchase of a cash register or a notification of a bank transfer in case of non-cash payment;

- certificate certifying the fact of tax registration of the enterprise (original and copy);

- certificate of registration of an individual entrepreneur or legal entity (original and copy).

Important points that should not be ignored

Registration in different cities of Russia can be carried out differently, so it is worth finding out in advance about the procedure for registering a cash register with the Federal Tax Service. At the same time, owners of individual entrepreneurs need to register the cash register at their place of residence, and organizations (for example, an LLC) directly at the address where the cash register will be located (rented or their own premises).

If the cash register needed for outbound trading, you can register it at your registration address(for individual entrepreneurs). But in this case, the registration procedure must be carried out at the territorial tax authorities, and not according to registration.

Maintenance of the cash register must be carried out in the city where the device will be located.

According to the order of the Ministry of Finance of the Russian Federation dated June 29, 2012 No. 94 n, the deadline for registering a cash register with the tax office is no later than 5 days from the moment the application is accepted by a representative of the tax authorities.

Also, it should be remembered that according to the law, a cash register can be used for no more than seven years from the date of its installation; then it will need to be deregistered by contacting the Federal Tax Service again.

If you find an error, please highlight a piece of text and click Ctrl+Enter.

The old procedure for registering cash registers was valid until 02/01/17. After this date, registration and re-registration of cash registers are carried out according to new rules. We will tell you how to register a cash register in tax, step-by-step instructions for carrying out this procedure, and new registration rules in this article.

New procedure for registering cash registers

According to paragraph 3 of Art. 7 of Law No. 290-FZ of 07/03/2016, companies and entrepreneurs had the right to register cash register machines in the old manner until 02/01/17. This procedure continues to be in effect until 07/01/17 in relation to the re-registration, application, deregistration of cash registers registered before 02/01/17. According to para. 13 clause 3 of the Decree of the Government of the Russian Federation No. 1173 of November 12, 2016 Resolution No. 470 will become invalid as of July 1, 2017.

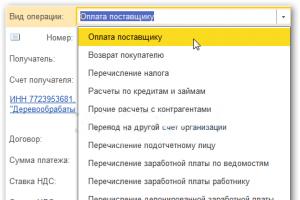

When registering cash registers from 02/01/17, companies and entrepreneurs must have a concluded agreement for the maintenance of cash register equipment, concluded with one of the fiscal data operators. A list of such operators and their data is available on the Federal Tax Service website.

From 02/01/17 registration of old-style cash registers is no longer possible. It will not be able to be registered by entrepreneurs or companies that can use old-style cash register machines before 07/01/18 (UTII payers, individual entrepreneurs on the patent system, persons providing services to the public with the issuance of BSO). The only exception to this rule concerns remote areas without the necessary communications, included in the list approved by the regional authorities. In these areas, it will still be possible to use cash registers without the online data transfer function through the fiscal operator.

KKM registration procedure according to the new rules

As before, only cash register equipment included in the cash register register can be registered. The contents of this register can be found on the Federal Tax Service website.

To register a cash register, you need to perform the following steps:

- Submit an application for KKM registration to the tax office;

- Enter information about the cash register and its user into the resulting fiscal drive;

- Generate and send a tax registration report.

Submitting an application to the tax authority

An application for registration/re-registration can be submitted in writing or electronically. To do this, you can use the capabilities of your personal account on the Federal Tax Service website. The application for registration of cash register must indicate the following basic information:

- information about the cash register user (full name of the company, full name of the entrepreneur, user’s tax identification number);

- address (for online stores, the website address is indicated) and location of installation of the cash register;

- information about the cash register (model, serial number);

- information about the fiscal drive (model, serial number);

- number of the automatic device for calculations (if used);

- information about using the cash register in offline mode (if the cash register will be used without transmitting fiscal data through the operator);

- information about the use of cash register only when providing services (in the case of registration of an automated system for BSO);

- information on the use of cash register systems only for payments using electronic money via the Internet.

Entering information into the fiscal drive

After submitting the application, the tax authority assigns a registration number to the registered cash register equipment. It and other information about the cash register and the user must be entered into the fiscal storage no later than the day (working day) after the day the application for registration is submitted.

If a cash register is registered with the tax office for an LLC or other company, the following information is entered into the fiscal drive:

- about the registration number of the cash register;

- full name of the user company;

- data on cash registers and fiscal storage.

If a cash register is registered with the tax office for an individual entrepreneur, the same data is entered into the fiscal drive as for a company, only instead of the name of the organization, the full name of the entrepreneur-user is indicated.

Generating and sending a registration report

After entering the specified data, the user generates a registration report and, no later than 1 day (working day) from the moment of receiving the cash register registration number from the tax office, transfers it to the tax authorities:

- on paper;

- through the cash register office;

- through the fiscal operator.